In case you thought paying $7 to $10 to trade a stock in the US was bad, it costs $65 in Australia. So now that it’s zero-fee stock trading app is thriving stateside with hundreds of thousands of users, Robinhood is planning to go international, starting in Australia. A $50 million cash infusion from NEA will fuel that expansion, as well as hiring and development of Robinhood first monetization feature. “Bringing the largest VC firm in history into the round is very confidence inspiring for customers”, co-founder Vlad Tenev told me.

Robinhood is swiftly fulfilling its mission to steal commission fees from online brokerages for the rich, and give access to the stock market to the poor. The company was founded in 2013 by Stanford grads Tenev and Baiju Bhatt [Disclosure: Tenev and Bhatt are friends of mine from college] after they’d tried their luck building algorithmic trading and investment bank software startups.

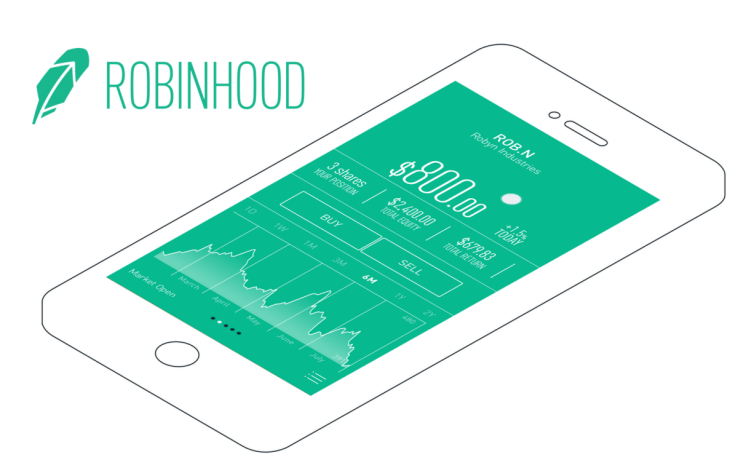

Together, they developed the Robinhood app where you can track stock performance and trade with no commission, rather than paying $7 to $10 to online brokerages like E*Trade or Scottrade. Those fees aren’t hard to swallow for rich people investing tens or hundreds of thousands of dollars. But they make it tough to win at the stock market because if you’re only investing small amounts, the fee might be more than your upswing. Removing the fees removes the barriers to trading for younger, poorer people who might not have traded stocks before.

Robinhood raised a $3 million seed from Index Ventures and Andreessen Horowitz in late 2013. Once it’d received clearance from the SEC and locked down security, Robinhood opened a waitlist in February 2014, and by September when it raised a $13 million Series A led by Index, it had a half million people wanting in. The app began rolling out in beta in December, and launched publicly in March.

Here’s a demo of the Robinhood app:

Now Robinhood is looking overseas thanks to the $50 million round led by NEA and joined by Vaizra Investments plus existing investors Index Ventures, Social Leverage, & Ribbit Capital. The round brings Robinhood’s total funding to date to $66 million as NEA’s Kittu Kolluri joins the Board alongside Index’s Jan Hammer & founders, Baiju Bhatt and Vlad Tenev.

from TechCrunch http://feedproxy.google.com/~r/Techcrunch/~3/GHpiRQ8f4A4/

via IFTTT

0 коммент.:

Отправить комментарий